The latest budget brings significant tax reforms aimed at making taxation simpler, fairer, and more transparent for individuals, businesses, and investors. Let’s break down the most important aspects, focusing on how they impact your income, savings, and investments.

1. Simplifying Taxation for a Developed India

- The government’s vision of Viksith Bharat (Developed India) includes:

- A new, simplified Income Tax Bill that cuts complex provisions in half

- Reducing litigation to ensure hassle-free tax compliance

- Ensuring tax certainty and making policies more responsive

2. New Income Tax Slabs & Benefits

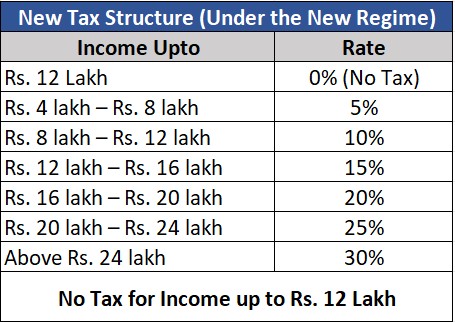

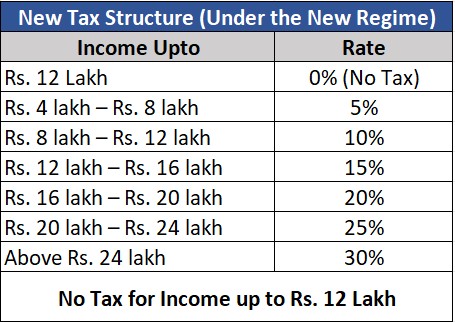

One of the biggest highlights of the budget is the revision of income tax slabs, reducing the tax burden for individuals.

Individuals earning up to Rs.12 lakh annually (Rs.1 lakh/month) will pay zero tax under the new tax regime.

For salaried taxpayers, after the Rs.75,000 standard deduction, the tax-free income limit becomes Rs.12.75 lakh.

3. How Will This Benefit You?

Example of Savings Compared to the Previous Tax Regime:

- If your income is Rs.12 lakh, you save Rs.80,000 in taxes (100% reduction).

- If your income is Rs.18 lakh, you save Rs.70,000 (30% reduction).

- If your income is Rs.25 lakh, you save Rs.1,10,000 (25% reduction).

- Impact: These tax cuts will increase household income, boost savings, and encourage investment in businesses and the economy.

4. Other Major Tax Proposals

TDS & TCS Reforms (Making Compliance Easier)

- TDS threshold for senior citizens' interest income raised from Rs.50,000 to Rs.1 lakh.

- TDS limit for rent payments increased from Rs.2.4 lakh to Rs.6 lakh.

- TCS limit for international remittances increased from Rs.7 lakh to Rs.10 lakh.

- Exemption on TCS for education remittances paid through loans.

5. Better Compliance & Taxpayer-Friendly Measures

- Time limit for updated income tax returns extended from 2 to 4 years, allowing taxpayers to correct past returns.

- Simplified registration & compliance for charitable trusts, with an extension of validity from 5 to 10 years.

6. Benefits for Property Owners & International Transactions

- No more tax restrictions on claiming two self-occupied properties.

- International tax disputes will be resolved faster with new safe harbor rules.

7. Senior Citizens’ Benefits

- Exemption for withdrawals from National Savings Scheme (NSS) after August 29, 2024.

- Extension of similar benefits to NPS (Vatsanya) accounts.

8. Boosting Investments & Job Creation

- Promoting Startups & Business Growth

- Startup tax benefits extended till April 1, 2030, giving businesses more time to grow.

- Investment benefits for businesses in IFSC (International Financial Services Centre), supporting insurance and treasury operations.

9. Encouraging Digitalization & Faster Dispute Resolution

- 100% digital tax processes to eliminate paperwork.

- The Vivaat Se Vishwaas scheme settled 33,000 tax disputes successfully.

Conclusion: What This Budget Means for You?

- More Savings: Higher tax-free income limit means more disposable income.

- Simpler Tax System: Fewer complexities and easier tax filing.

- More Investment & Jobs: Business-friendly reforms encourage economic growth.

- Better Compliance Measures: Lower penalties and easier registration processes.

This budget aims to make taxation simpler, reduce burdens on the middle class, and promote growth opportunities for businesses and startups.

Would you like to explore specific tax benefits based on your income level or profession? Go Through the above article and share your feedback on https://forms.gle/RMs3hVzHNBRPovLD7