Investing for the long term is one of the smartest ways to build wealth, and in India, Systematic Investment Plans (SIPs) are a preferred method for disciplined investors. Many aspiring investors often ask: “How much monthly SIP will make me a crorepati in 16 years?”

In this article, we will break down the numbers, explain the logic, and provide practical tips for building a corpus of 1 crore INR over 16 years, along with examples and strategies to maximize your wealth.

A Systematic Investment Plan (SIP) allows you to invest a fixed amount of money at regular intervals in mutual funds. Instead of investing a lump sum, SIP spreads your investment over time, making it easier to manage cash flow and benefit from the power of rupee cost averaging.

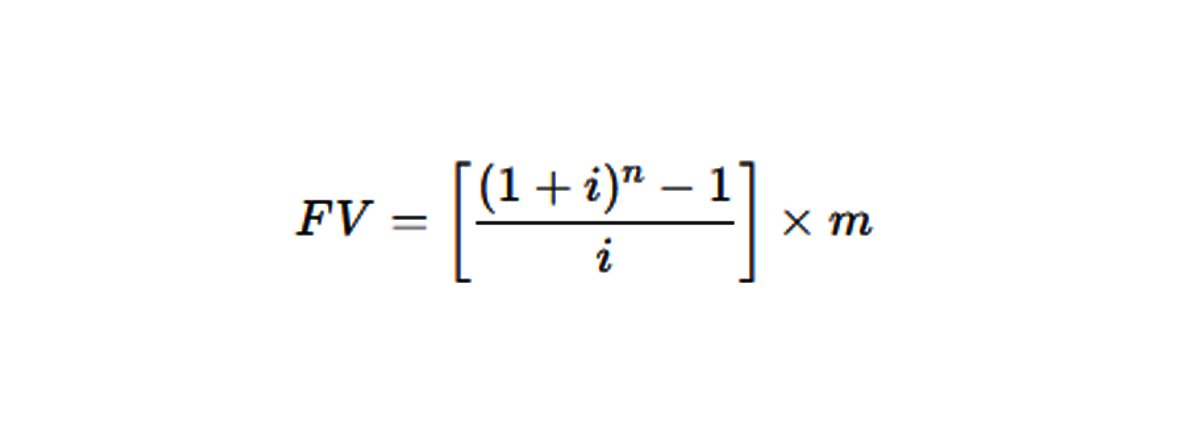

To calculate the future value of your SIP, the standard formula is:

Where:

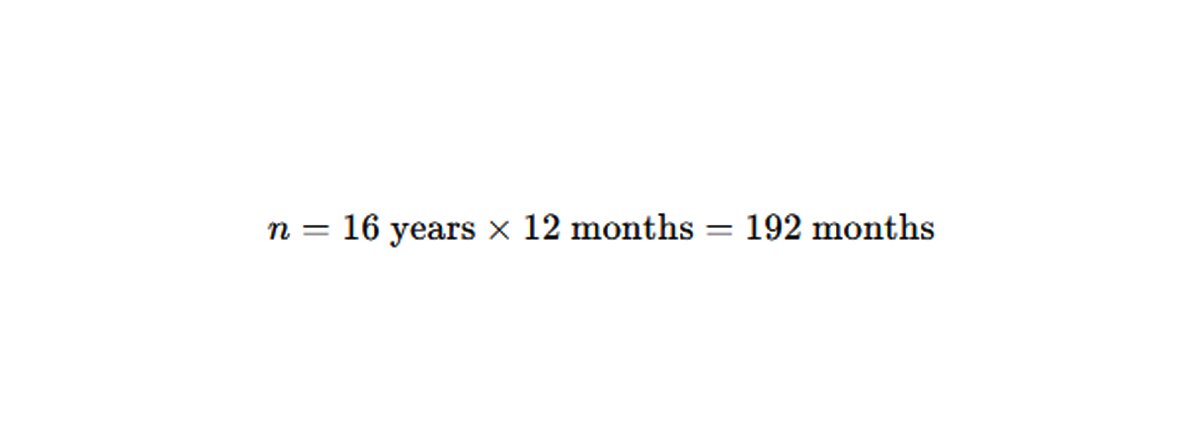

For a 16-year plan:

Assuming an average annual return of 12%, which is reasonable for equity mutual funds in India, the monthly interest rate i is 1% (12% ÷ 12 months).

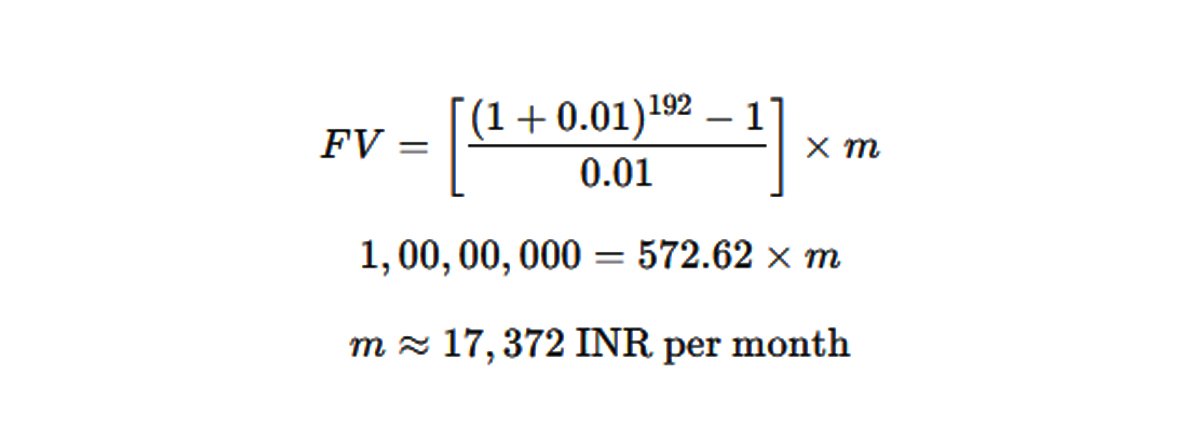

Using the formula:

So, investing around Rs. 17,372 per month for 16 years at 12% annual returns can make you a crorepati.

This is a simplified estimate but provides a realistic benchmark for planning.

While the above calculation works, it assumes a flat contribution over 16 years. But real life is dynamic:

If you start with Rs. 17,372 per month and increase your contribution by 8% every six months, your investment could grow to Rs. 2.9 crore instead of just Rs. 1 crore over the same period.

This approach leverages both compound interest and your increasing earning capacity.

Not all SIPs allow for increasing contributions. Many investors continue with flat monthly investments, which may limit growth. Here’s why:

In India, many mutual fund platforms now offer flexible SIPs where you can increase your monthly contribution automatically. By increasing your SIP by 5–10% every 6–12 months, you can dramatically enhance your wealth.

Let’s compare two scenarios for 16 years at 12% annual returns:

| Scenario | Initial SIP | Increment | Corpus After 16 Years | |

| Flat SIP | Rs. 17,372/month | 0% | Rs. 1 Crore | |

| Floating SIP | Rs. 17,372/month | 8% every 6 months | Rs. 2.9 Crore |

As you can see, small incremental contributions can nearly triple your final corpus.

While basic SIP calculations provide a starting point, professional financial planning considers:

Professional planners often provide a detailed retirement roadmap, ensuring your investments stay on track even in market downturns.

At ExploreRealNews.com, we aim to simplify financial planning for our readers. While SIP calculators provide estimates, we emphasize understanding your own financial goals and investing smartly.

The goal is not just becoming a crorepati, but also building financial discipline, resilience, and long-term wealth. Small, disciplined steps today can lead to life-changing wealth tomorrow. Stay connected with www.explorerealnews.com. Follow us on Instagram: @ExploreRealNews | Facebook: ExploreRealnews | Twitter: @ExploreRealNews | LinkedIn: ExploreRealNews

Becoming a crorepati in 16 years through SIPs is entirely possible if you invest Rs. 17,372 per month at 12% annual returns. By leveraging floating SIPs and incremental contributions, you could grow your wealth to Rs. 2.9 crore over the same period.

The key takeaway: start early, invest consistently, and let compounding do its magic. SIPs are not just a tool for investment—they are a pathway to financial freedom.

Disclaimer: The information shared in this article is for educational and informational purposes only. It does not constitute financial advice. Before making any investment decisions, please consult a certified financial advisor to ensure the strategy aligns with your personal financial goals and risk profile.